Trusted shipping

Easy returns

Secure shopping

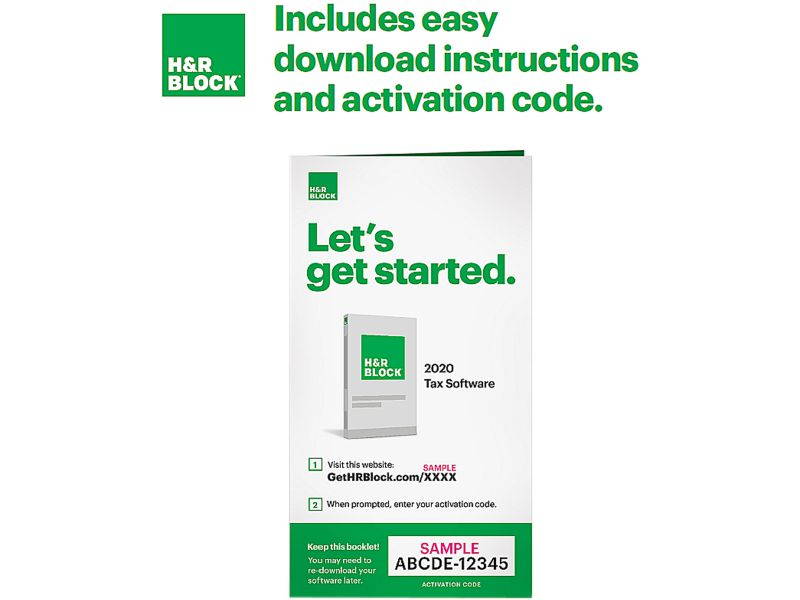

Buy H&R BLOCK Tax Software Premium & Business 2020 PC Windows (Key Card) in United States - Cartnear.com

H&R BLOCK Tax Software Premium & Business 2020 PC Windows (Key Card)

CTNR1165162 0735290106995 CTNR1165162H&R Block

2027-02-28

/itm/hr-block-tax-software-premium-business-2020-pc-windows-key-card-1165162

USD

86.23

$ 86 $ 88 2% Off

Item Added to Cart

customer

*Product availability is subject to suppliers inventory

SHIPPING ALL OVER UNITED STATES

100% MONEY BACK GUARANTEE

EASY 30 DAYSRETURNS & REFUNDS

24/7 CUSTOMER SUPPORT

TRUSTED AND SAFE WEBSITE

100% SECURE CHECKOUT

| Disclaimer | @ 2020 HRB Digital LLC. All rights reserved. H&R Block is a registered trademark of HRB Innovations Inc. TurboTax is a registered trademark of Intuit, Inc. For sale by authorized retailers only. |

|---|---|

| Brand | H&R BLOCK |

| Model | 1536600-20 |

| Type | Tax |

| Name | Tax Software Premium & Business 2020 |

| Version | Premium & Business |

| Operating Systems Supported | Windows |

| Packaging | Retail |

| System Requirements | Minimum System Requirements for Windows Operating System: Windows@ 8.1 / 10 Browser: Windows: Internet Explorer@ 11 or higher Hard-Disk Space: 170 MB Monitor: 1024x768, SVGA color monitor Printer: Compatible inkjet or laser Speakers and Sound Card: For videos / animations Internet Connection Required |

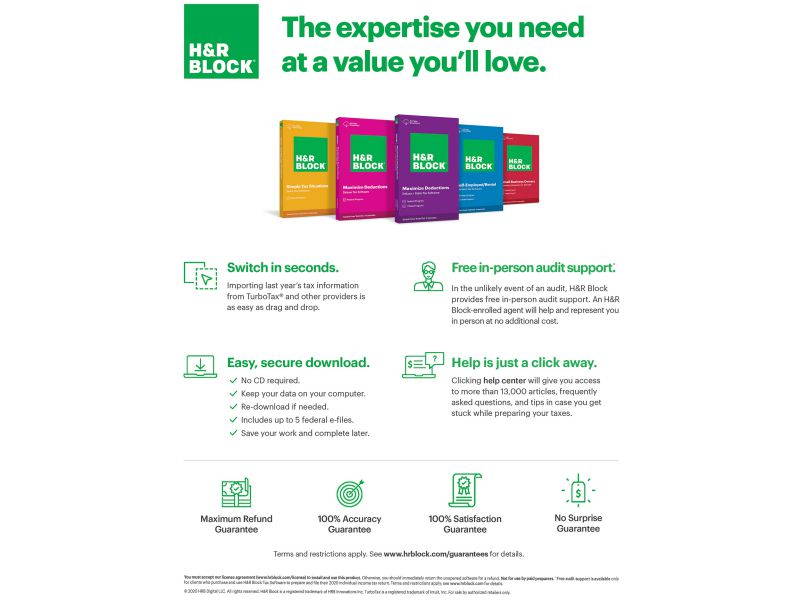

| Feature | H&R Block Premium & Business Tax Software offers everything people need to easily file complex federal and state and business taxes and get their maximum refund-guaranteed. It includes step-by-step guidance on more than 350 credits and deductions, a help center with over 13,000 searchable articles, and in-person representation in the unlikely event of an audit. Supports filing tax returns for S corporations, partnerships, LLCs, nonprofits, estates, and trusts, and trusts, and provides small business resources for payroll, employer (W-2 AND 1099) forms, and more. Step-by-step Q&A and guidance on all available credits and deduction Quickly import your W-2,1099,1098, and last year's personal tax return, even from TurboTax and Quicken Software Easily import from TurboTax and Quicken Software Itemize deductions with Schedule A Accuracy Review checks for issues and assesses your audit risk Five free federal e-files and unlimited federal preparation and printing Reporting assistance on income from investment, stock options, home sales, and retirement Guidance on maximizing mortgage interest and real estate tax deduction (Schedule A) H&R Block DeductionPro values and optimizes charitable donations (Schedule A) Tax calculators to help determine the cost basis of sale, dividend, gift, and inheritance assets Advanced Schedule C guidance to maximize deductions for self-employment income Schedule E guidance for rental property income and expenses Free e-file included for most business forms Get guidance for, prepare, and file corporate and S-corporation tax returns (Forms 1120,1120S), partnership and LLC tax returns (Form 1065), estate and trust tax returns (Form1041), and nonprofit tax returns (Form 990) Create payroll (940 &941) and employer (W-2 &1099) forms Maximize your tax benefits for vehicle deductions, depreciation, business expenses Unlimited business state programs included |